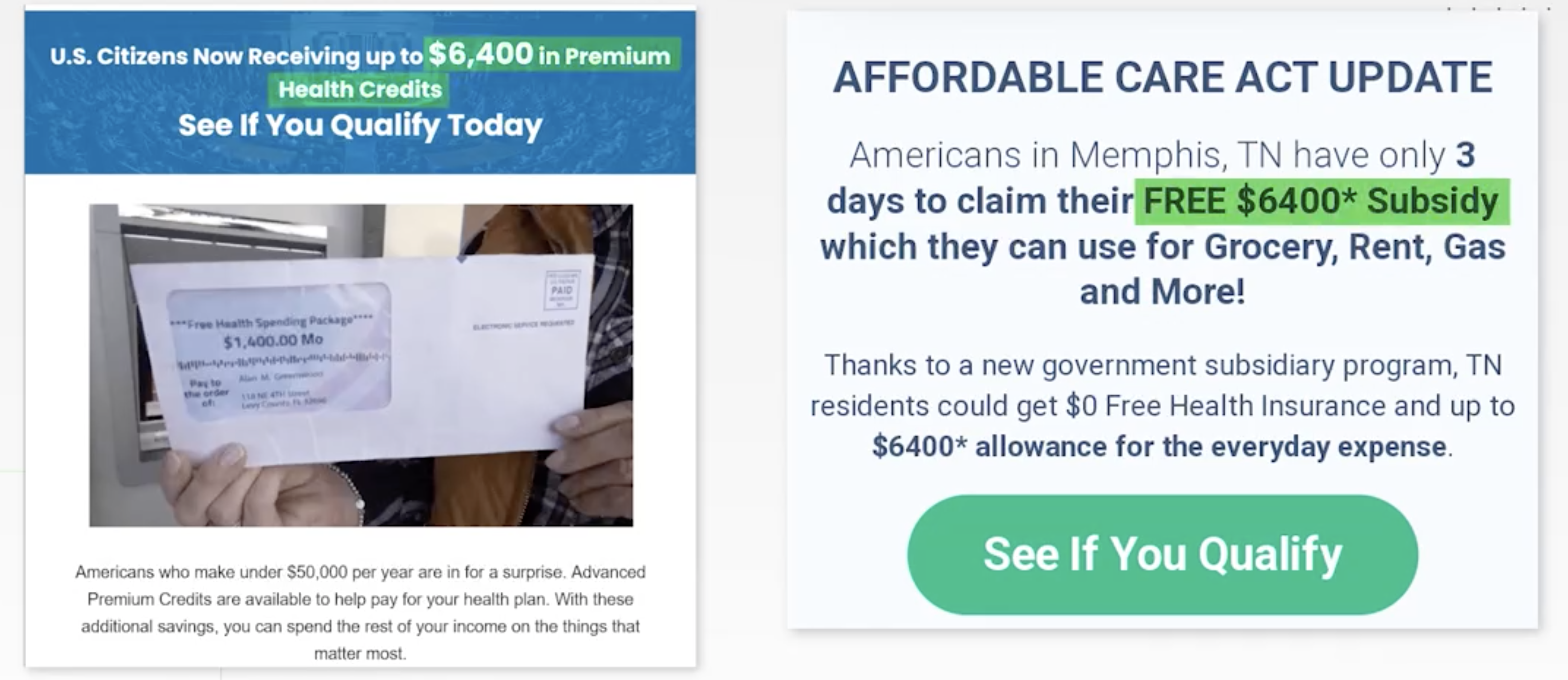

You may have seen ads like these ones on your social media feed recently. With open enrollment now underway for 2024 – advertisers may be increasing the frequency of running these. Ads may have offers like “$0 health insurance plan” with a “$6,400 credit benefit” – with links to websites to qualify.

Is there a $6,400 health subsidy?

The short answer is yes – but it’s likely not what you’ve seen in the advertisements. These subsidies are not pre-paid visa cards or cash that you receive directly from the government — rather — they are credits you can use toward your health insurance premiums. The amount of credit you can receive depends on the amount you make (see below). If you are currently paying the full premium on your insurance policy – and you qualified for a health subsidy – you may be able to apply this as a tax credit – which may result in a tax refund in certain circumstances.

How do health credit subsidies actually work?

A tax credit you can use to lower your monthly insurance payment (called your “premium”) when you enroll in a plan through the Health Insurance Marketplace®. Your tax credit is based on the income estimate and household information you put on your Marketplace application.

Federal poverty levels (FPLs) & premium tax credit eligibility

- Income between 100% and 400% FPL: If your income is in this range, in all states you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan. Note: If your income is at or below 150% FPL, you may qualify to enroll in or change Marketplace coverage through a Special Enrollment Period.

- Income above 400% FPL: If your income is above 400% FPL, you may now qualify for premium tax credits that lower your monthly premium for a 2022 Marketplace health insurance plan.

You can use all, some, or none of your premium tax credit in advance to lower your monthly premium.

- If you use more advance payments of the tax credit than you qualify for based on your final yearly income, you must repay the difference when you file your federal income tax return.

- If you use less premium tax credit than you qualify for, you’ll get the difference as a refundable credit when you file your taxes.

*Information above sourced from https://www.healthcare.gov/glossary/premium-tax-credit/

How can I find out if I qualify for any subsidies or tax credits?

The experts at National Health Credit are here to help answer your questions. We help people just like you every day get answers to your questions about ACA (Affordable Care Act) health insurance — especially which credits and premium reductions you are eligible for. Contact an expert free of charge today to get your questions answered.